Resource Tax on Material A

.jpg)

Resource tax on rare earths in China: Policy evolution and market

2018年12月1日 The resource tax on RE in China has evolved over time and includes three stages: 1) establishment (1993–2010), 2) quantitative changes (2011–2014); and change to a volumebased system and qualitative changes in the ad valorem system (2015 to the present)2021年2月1日 In Section 2, we set out how mining is typically taxed In Section 3, we explore the emerging trends, as well as old and new challenges that have motivated The Future of Resource Taxation In Section 4, we explain the various steps involved in the dialogue, how stakeholders THE FUTURE OF RESOURCE TAXATION: A ROADMAP2021年1月21日 This contribution presents a comprehensive taxation framework, applied across the life cycle of products The framework includes (1) a raw material resource tax, (2) reuse/repair tax relief, and (3) a waste hierarchy tax Towards a Circular Economy Taxation 2019年8月26日 Article 1 The entities and individuals that develop taxable resources within the territory of the People's Republic of China and other sea areas under the jurisdiction of the People's Republic of China are the resource taxpayers, and shall pay resource tax in Resource Tax Law of the People's Republic of China

Resource tax on rare earths in China: Policy evolution and

2018年12月1日 The resource tax on RE in China was established in 1994 and reformed in 2011 and 2015 We follow and analyze the evolution of the resource tax on RE from its establishment (1994–2010), to a quantitative change (2011–2014), and to a qualitative change (2015 to 2023年2月11日 PDF On Jan 1, 2020, Rujia Chen published Domestic Resource Taxation Makes One Solution to the Rare Earth Dispute in WTO — Insights into China’s Resource Taxation Find, read and cite all Domestic Resource Taxation Makes One Solution to the2012年7月25日 It is necessary to levy a resource tax that reflects the real cost of coal resources The results of our calculations show that from 1992 to 2009, the theoretical ad valorem coal tax rate determined in accordance with the user cost fluctuated between 2 and 14 percentResource Tax Reform: A Case Study of Coal from the 2017年5月11日 classification of material and resource taxes proposed in [4], the input tax falls into the category of taxation of materials when they enter into production, and the output tax as a tax levied on resourceintensive final products We use a multisector dynamic stochastic general equilibrium (DSGE) model of the EU27 areaInput vs Output Taxation—A DSGE Approach to

.jpg)

Resource Tax Reform: A Case Study of Coal from the

2012年7月25日 It is necessary to levy a resource tax that reflects the real cost of coal resources The results of our calculations show that from 1992 to 2009, the theoretical ad valorem coal tax rate determined in accordance with the user cost fluctuated between 2 and 14 A 2023年12月18日 material resource tax has high environmental utilization [14] In contrast, domestic research on resource tax has focused on tax basis, choice of tax and fee, and the Chinese resourceOptimal Tax Rate and Its Effect on Copper Mine 2011年9月1日 The framework includes (1) a raw material resource tax, (2) reuse/repair tax relief, and (3) a waste hierarchy tax at the end of life of products The research is based on a mixed method approach Taxing Virgin Natural Resources: Lessons from Aggregates Taxation Natural resources are typically subject both to taxation under the income tax system and to special resource taxes Properly designed income taxes attempt to include The taxation of natural resources : principles and policy issuesThe taxation of natural resources : principles and policy issues

.jpg)

Resource Tax Research Based on Resource Price

2018年9月7日 Resource Tax Research Based on Resource Price Optimization Hongmei Ye Xi’an International University, Xi’an, Shaanxi Natural resources are the material basis on which human beings depend The development of human beings is inseparable from the consumption of resources The exploitation, distribution and2021年9月1日 Resource taxes have a weak impact on CO 2 emissions and air pollutant emissions, and their environmental protection effect is not obvious 53 Simulation of the macroeconomic impact of a carbon tax and a resource tax The increasing of a resource tax rate reduces enterprise export and economic growthA comparative study on the environmental and economic effects 2018年12月1日 Rare earths (RE) are critical minerals that are used for economic development Because it has become increasingly important and widely used, the resource tax has been implemented to solve the negative externality of RE exploitation in China The resource tax on RE in China has evolved over time and includes three stages: 1) establishment (1993–2010), 2) Resource tax on rare earths in China: Policy evolution and 2012年7月1日 Numerous raw materials, particularly construction minerals, remain relatively cheap (Sverdrup et al, 2017), therefore commodity prices fail to represent resource scarcity (Popp et al, 2018)(PDF) Taxing construction minerals: a contribution to a resource

.jpg)

Taxes on construction minerals in Europe and tax rates

Numerous raw materials, particularly construction minerals, remain relatively cheap (Sverdrup et al, 2017), therefore commodity prices fail to represent resource scarcity (Popp et al, 2018)2023年2月11日 O nl y one ye ar after the WTO ruled agai nst China on the raw material di spute, the United States, the Europe an Union and Japan sued China in respect Reason s to Use Resource Tax ationDomestic Resource Taxation Makes One Solution to the2024年2月20日 Using panel data from Chinese Ashare listed enterprises from 2013 to 2021, this study employs the differenceindifference model to examine the impact of water resource tax reform on corporate green technology innovation The results demonstrate that the water resource tax reform significantly promotes corporate green technology innovation Further analysis The Impact of Water Resource Tax Reform on Green 2021年9月1日 Hu et al (2021) compared the resource tax and carbon tax policies from the aspects of energy utilization, government tax and so on and found that the carbon tax can reduce energy consumption and A comparative study on the environmental and economic

Analysis of the FeetoTax reform on water resources

1 Analysis of the FeetoTax reform on water resources in China Zirui Chen Guangdong Academy of Social Science, Guangzhou, , PR China Puyan Nie School of Finance, Institute of Guangdong 2024年1月1日 Studies and the development experiences of already developed nations suggest that resource taxes are a crucial financial tool to offset the increasing cost of natural resources (Lin et al, 2023)They hold significant policy implications for promoting responsible resource exploitation and conserving the environment (Hu et al, 2021)The resource tax essentially Will resource tax reform raise green total factor productivity 2020年4月23日 The strategic direction of the European Union (EU) over the past twenty years has focused on increasing resource productivity and innovation in the economy, aiming at the efficient use and secured (PDF) Policy Framework for Material Resource Efficiency: Pathway The framework includes (1) a raw material resource tax, (2) reuse/repair tax relief, and (3) a waste hierarchy tax at the end of life of products The research is based on a mixed method approach The material market impacts of a virgin materials tax

Optimal Tax Rate and Its Effect on Copper Mine Resource Tax

2018年9月16日 The effect of resource tax collections focused on the impact on specific industries Kunce explored the consequences of tax changes on the oil industry in the United States [13] Söderholm and Klaassen analyzed mineral products consumption and showed that the mineral raw material resource tax has high environmental utilization [14]2020年8月25日 Carbon tax and some other policies are designed to reduce emissions; resource tax can raise the energy price from the supply side to achieve the purpose of emission mitigation Based on previous Supply control vs demand control: why is resource tax more 2024年1月19日 The existing system ought to be replaced by a resource rent tax either as a pure system or in combination with a corporate income tax system View fulltext ChapterRent taxes on natural resources in Norway: A short overview2010年7月2日 Please find the importance of Tax Indicator Tax indicator for material Use The tax indicator is used in the automatic determination of the tax code in Purchasing The tax code can be determined automatically within the framework of price determination (via the conditions) Tax indicators are used to facilitate this process They can be Solved: Tax indicator for material (Purchasing) SAP

.jpg)

Resource tax on rare earths in China: Policy evolution and market

2018年8月1日 The resource tax on RE in China has evolved over time and includes three stages: 1) establishment (1993–2010), 2) quantitative changes (2011–2014); and change to a volumebased system and 2024年1月21日 China is taking measures to minimize the negative impact of the longterm extensive water use model on the water environment The large number of zombie enterprises with high energy consumption and low energy efficiency in highly waterconsuming industries is one of the important reasons for the water resource governance plight of China Based on the The Impact of Water Resource Tax on the Sustainable 2023年6月9日 how to define tax rate for a material whose unit price is below 1000(tax applied 5% as unit price below 1000) and for other material code unit price is above 1000(tax Material Staging in Production Supply AreaWM/PP Integration in Enterprise Resource Planning Blogs by Members Monday;how to define tax rate with reference to material code2019年5月24日 Use of Treasury material under a Creative Commons BY Attribution 30 Australia licence requires you to attribute the work (but not in any way that suggests that the Treasury Petroleum Resource Rent Tax Review Final Report In accordance with the Terms of Reference, I am pleased to present the Final Report of thePetroleum Resource Rent Tax Review Treasury

.jpg)

A North Carolina Sales and Use Tax Guide for Real Property

2024年3月30日 See SUTB 4 As a result, contractors may owe additional use tax on materials transferred as part of a capital improvement in a location that has a higher county rate For example, materials purchased in Hertford but transferred to a customer in Durham may result in use tax liability because of the halfpercent difference in county rates2024年6月25日 Report setup Before you can generate the Natural resources tax report, you must set up the lines for each report layout Repeat the following steps for every line in each report layout Click Tax > Setup > Sales tax > Natural resources tax report setup Click New In the Form number field, select the form to set up: Form 2 – This form shows information about Tax on natural resources report Finance Dynamics 年10月1日 The resource tax rate path and annual rate of demand shift is set to be consistent with the previous study from the UNEP IRP report (UNEP, 2019) The second scenario is the Climate Mitigation policy package This involves three measures for GHG emissions abatement including a yearbyyear uniform global carbon tax, development of CDR Resource efficiency and climate change policies to support 2021年9月1日 This paper is a comparative study on the effects of a resource tax and a carbon taxIn this paper, we use the computable general equilibrium (CGE) approach to simulate the impact of China's increasing resource tax rate policy and carbon tax policy The strengths and weaknesses of the two policies are compared from the perspective of energy utilization, air A comparative study on the environmental and economic effects

.jpg)

The impact of resource tax reform on China's coal industry

Downloadable (with restrictions)! Contributing to approximately twothirds of primary energy consumption, coal usage is the focus of China's energy policies To regulate the resource taxation system and reduce the burden of coal enterprises, the Chinese government launched a reform of its resource tax system in 2014 for coal, introducing the ad valorem system to replace the 2017年5月11日 classification of material and resource taxes proposed in [4], the input tax falls into the category of taxation of materials when they enter into production, and the output tax as a tax levied on resourceintensive final products We use a multisector dynamic stochastic general equilibrium (DSGE) model of the EU27 areaInput vs Output Taxation—A DSGE Approach to 2012年7月25日 It is necessary to levy a resource tax that reflects the real cost of coal resources The results of our calculations show that from 1992 to 2009, the theoretical ad valorem coal tax rate determined in accordance with the user cost fluctuated between 2 and 14 A Resource Tax Reform: A Case Study of Coal from the 2023年12月18日 material resource tax has high environmental utilization [14] In contrast, domestic research on resource tax has focused on tax basis, choice of tax and fee, and the Chinese resourceOptimal Tax Rate and Its Effect on Copper Mine

.jpg)

Taxing Virgin Natural Resources: Lessons from Aggregates Taxation

2011年9月1日 The framework includes (1) a raw material resource tax, (2) reuse/repair tax relief, and (3) a waste hierarchy tax at the end of life of products The research is based on a mixed method approach Natural resources are typically subject both to taxation under the income tax system and to special resource taxes Properly designed income taxes attempt to include The taxation of natural resources : principles and policy issuesThe taxation of natural resources : principles and policy issues2018年9月7日 Resource Tax Research Based on Resource Price Optimization Hongmei Ye Xi’an International University, Xi’an, Shaanxi Natural resources are the material basis on which human beings depend The development of human beings is inseparable from the consumption of resources The exploitation, distribution andResource Tax Research Based on Resource Price 2021年9月1日 Resource taxes have a weak impact on CO 2 emissions and air pollutant emissions, and their environmental protection effect is not obvious 53 Simulation of the macroeconomic impact of a carbon tax and a resource tax The increasing of a resource tax rate reduces enterprise export and economic growthA comparative study on the environmental and economic effects

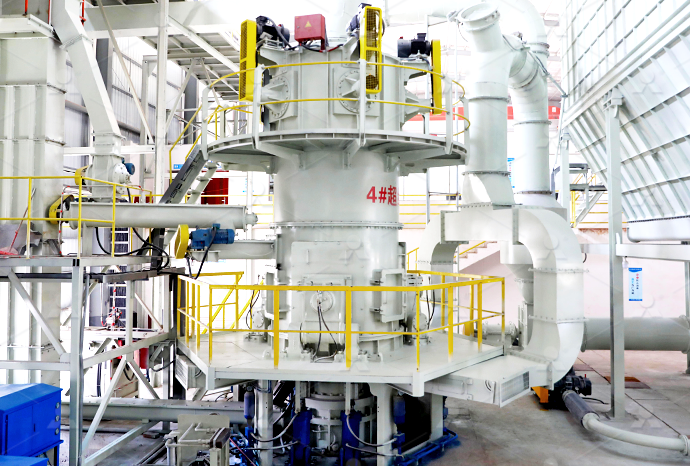

CFB石灰石脱硫剂制备64.jpg)

Resource tax on rare earths in China: Policy evolution and

2018年12月1日 Rare earths (RE) are critical minerals that are used for economic development Because it has become increasingly important and widely used, the resource tax has been implemented to solve the negative externality of RE exploitation in China The resource tax on RE in China has evolved over time and includes three stages: 1) establishment (1993–2010), 2) 2012年7月1日 Numerous raw materials, particularly construction minerals, remain relatively cheap (Sverdrup et al, 2017), therefore commodity prices fail to represent resource scarcity (Popp et al, 2018)(PDF) Taxing construction minerals: a contribution to a resource Numerous raw materials, particularly construction minerals, remain relatively cheap (Sverdrup et al, 2017), therefore commodity prices fail to represent resource scarcity (Popp et al, 2018)Taxes on construction minerals in Europe and tax rates