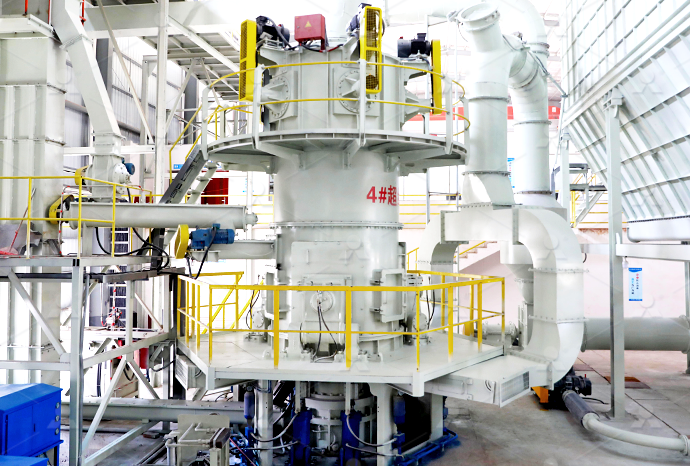

Pulverizing workshop resource tax

.jpg)

Resource Tax Reform: A Case Study of Coal from the

2012年7月25日 Using the adjusted El Serafy user cost approach to estimate the depletion cost of coal resources, this paper demonstrates that user cost exists in the exploitation of China’s 2012年8月1日 进一步通过动态可计算一般均衡 (CGE) 模型分析从价煤炭资源税对宏观经济 的影响, 可以发现, 对煤炭资源征收5%—12%的从价资源税, 宏观经济成本将在可 承受范围之内, 而 Resource Tax Reform: A Case Study of Coal from the 2024年1月1日 Our findings reveal a significant increase in GTFP following resource tax reform The main contribution of this article lies in constructing a multitime point differencein Will resource tax reform raise green total factor productivity 2023年1月24日 The double difference method is used to evaluate the policy effect of the reform of resource tax collection The research shows that: (1) Changing the resource tax from a Environmental Protection or Development? Multiple Policy

.jpg)

The impact of resource taxation on resource curse: Evidence

2022年9月1日 Based on the panel data of 114 resourcebased prefecturelevel cities in China, we empirically investigate the impact of resource taxes on economic growth and resource 2022年9月1日 Based on the panel data of 114 resourcebased prefecturelevel cities in China, we empirically investigate the impact of resource taxes on economic growth and resource The impact of resource taxation on resource curse: Evidence 2021年9月1日 China has made a series of adjustments to its resource tax system in order to save resources, strengthen environmental protection, and reduce pollutant emissions In 2010, A comparative study on the environmental and economic effects 2024年1月1日 Pulverized coal for blast furnace injection requires high combustibility, reducing the content of unburned pulverized coal in the furnace, improving the coal coke displacement Pulverized Coal Injection of Blast Furnace Ironmaking

Supply control vs demand control: why is resource tax more

2020年8月25日 Carbon tax and some other policies are designed to reduce emissions; resource tax can raise the energy price from the supply side to achieve the purpose of emission 2020年9月1日 The new law, based on the provisional regulations on resource tax, introduces unified tax items, clarifies the authorization for determining tax rates, and standardizes tax China's resource tax law to take effect on Sept 1 State 2015年6月3日 Resource Projects 1 The income tax law contains a basic set of rules which apply to the taxation of all types of resource projects There are then further specifi c rules which apply to different types of resource projects ie mining, petroleum and gas projects 2 The rates of taxation on mining, petroleum and gas income in Papua NewPapua New Guinea Resource Project Taxation PwCEach workshop includes a QA portion with the speakers as well The ED Sales Tax Workshop is the required training under the Texas Local Government Code Section 502101 governing Type A and Type B EDCs The cost of registration Economic Development Sales Tax Workshops /

.jpg)

The impact of resource taxation on resource curse: Evidence

2022年9月1日 1 Introduction The “resource curse” has been proposed (Auty, 1994) to explain the phenomenon whereby a wealth of natural resources hinders the sustainable development of an economy and even leads to stagnation or retrogression rather than providing a longterm impetus for economic growthIn recent decades, many countries, such as Nigeria, Iran, 2022年11月23日 Thank you for volunteering for the Property Tax Protest Workshops SALSA is collaborating with the City of San Antonio Texas Rio Grande Legal aid to facilitate these workshops in each city council district Resources Exemptions112322pdf (bcad) 96295 Property Taxpayer Remedies (bcad)Property Tax Protest Workshops Resource Page San 2024年3月13日 REGIONAL WORKSHOP ON TAX EXPENDITURES Sourcebook for Workshop Participants 3 WORKSHOP AGENDA Day 1: Governance, Estimation, and Reporting of Tax Expenditures 08:30 –09:00 Registration 09:00 –10:00 Welcome Address Introduction ATI, FIRS, ECOWAS, WATAF, ATAF IDOS / CEP 10:00 –11:20 Session 1 – A Governance REGIONAL WORKSHOP ON TAX EXPENDITURES Addis 2024年11月26日 AgriLife Bookstore AgriLife Extension's online Bookstore offers educational information and resources related to our many areas of expertise and programming; from agriculture, horticulture, and natural resources to nutrition, wellness for Resources Tax Workshops

Will resource tax reform raise green total factor productivity

2024年1月1日 Studies and the development experiences of already developed nations suggest that resource taxes are a crucial financial tool to offset the increasing cost of natural resources (Lin et al, 2023)They hold significant policy implications for promoting responsible resource exploitation and conserving the environment (Hu et al, 2021)The resource tax essentially 2024年6月14日 These workshops are designed to help you, a new business owner, understand and meet your federal tax obligations These lessons are constructed so that the first four segments: Federal Taxes And Your New Business, Schedule C and Other Small Business Taxes, How to File and Pay Your Taxes Electronically, and Business Use of Your Home, may be IRS Small Business Tax Workshops SCORE4 天之前 The Tax Institute is Australia's leading professional association and educator in tax, providing the best resources, professional development and networks Learn more Our people Councils Committees; Leadership team; Tax Policy Advocacy team Intensives and Workshops Short half day, full day, in person or online events, that go in Masterclasses, Intensives and Workshops The Tax Institute4 天之前 Tax Briefs Attendees will be updated on recent tax issues and learn about the practical impact of recent tax changes You’ll also learn how to apply the changes in a client context and how to recognise planning opportunities Tax Updates cover important tax issues, such as: Income tax, including CGT Other taxes such as GST and FBT Tax Tax Workshops TaxBanter Pty Ltd

19 Best Free Workshop Resources SessionLab

2023年8月3日 8 Most Popular Facilitation Libraries In the first part of this article, we will list toolkits beloved by facilitators all over the world This is based on responses to the 2023 State of Facilitation survey There are great reasons for PitBullTax Hybrid Workshops Virtual and OnSite Tax Resolution Training The only program of its kind Designed for those tax professionals who want to learn or finely tune their tax resolution skills, PitBullTax Institute uniquely combines PitBullTax Institute1 天前 Mission – Texas AM AgriLIfe Extension Tax Workshops provide learnerfocused sessions for tax practitioners, so that they can benefit professionally and better serve the community Program Texas AM AgriLife Extension Tax Workshops has been providing quality tax workshops at reasonable prices for professionals in Texas for the past fifty years Our About Tax Workshops2 天之前 This three day workshop will focus on the fundamentals of tax compliance across all taxes, including changes to the taxes laws and the current practical challenges facing taxpayers We shall also cover the computation of Deferred Tax The workshop will be case study and problemsolving driven, rather than just theoreticalAll Taxes Training Series Deloitte Kenya Tax

.jpg)

Business Tax Seminars Workshops Webinars NCDOR

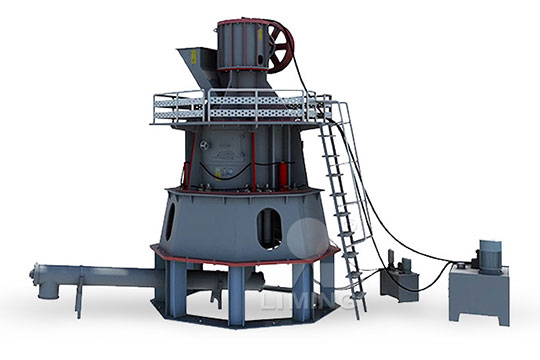

3 天之前 Information and Resources on Hurricane Helene Business Tax Seminars Workshops Webinars Contact Information North Carolina Department of Revenue PO Box 25000 Raleigh, NC 276400640 General information: 18772523052 Individual income tax refund inquiries: 18772524052Tax vacancies We have plenty of interesting opportunities for the next step in your tax career View vacancies Inhouse tax professional for 1 day Efficient flexible solutions Read more Dealing with tax data Ready for the future of tax reporting? Choose the right technology with us Videointerview No the time to come to our office?HOME The Resource2023年6月15日 Coal sheds and pulverizing workshops are usually transported by belts (2) Dry gas preparation system includes flue gas fan, combustion furnace, combustion fan, and flue gas pipeline The dry gas from the combustion furnace is mixed with cold air to form a gas with a temperature of 20–300 °C as the drying medium and sent to the coal mill to Pulverized Coal Injection of Blast Furnace IronmakingGain an understanding of withholding tax and how it affects your business in the introductory Withholding Tax workshop that will shed light on the types of payments that are subject to withholding tax as well as the compliance requirements Key Topics What is withholding tax; Types of payment subject to withholding tax: Interest; RoyaltiesWithholding Tax 52nd Run TAKX

.jpg)

National Resources Tax Conference The Tax Institute

4 天之前 The National Resources Tax Conference is the only conference in Australia focusing specifically on tax practitioners in this space Industry experts and an expansive technical program This excellent conference held over two days will provide updates on the tax issues that are front of mind for industry2023年2月15日 Taxes for Artists / Workshop Wednesday, February 15, 56:15 pm Sliding Scale (registration closes at 10 am the day of the event) individual artists through grant programs and provides a comprehensive suite of professional development training and resources to help artists achieve their career goalsTaxes for Artists / Workshop Artist Trust2024年1月19日 The existing system ought to be replaced by a resource rent tax either as a pure system or in combination with a corporate income tax system View fulltext ChapterRent taxes on natural resources in Norway: A short overview2024年10月24日 Industries are liable for national resource tax (NRT) if they are using or developing Vietnam’s natural resources, such as metallic and nonmetallic minerals, crude oil, natural gas, petroleum minerals, forest products (except for animals), aquatic products, natural water, and swallow’s nestsVietnam’s Natural Resource Tax 2024 Vietnam Briefing News

Tax Workshop

Welcome to the 2024 Tax Practitioner Workshop series! The Tax Practitioner Workshops are now being hosted by Texas AM AgriLife Extension and the Department of Agricultural Economics The new program manager for the Tax Importantly the workshops are not designed to cover tax topics in an extremely technical way but rather give attendees a practical understanding of the key tax issues through a combination of lectures, interaction and practical case studies Our workshops can Tax Workshops Events PwC Papua New Guinea3 天之前 Intended for smaller firms and sole practitioners, our Tax Workshops are a great way to stay uptodate in a comfortable group environment We present a monthly Tax Brief, along with an indepth Special Topic, in 8 locations nationally Resources FAQs; TaxBanter resources downloads; Login to a webinar;TaxBanter Industry Leading Tax Training Online or Face to 2024年4月12日 Some of this process' most significant benefits include the following Enhanced particle size: Wet pulverizing can achieve smaller particles than dry pulverization methods The final product is also often more uniform than dry pulverization products, which is essential for pharmaceuticals, cosmetics and other industries; Reduced fire hazards: The liquid within the Dry vs Wet Pulverization Key Differences Applications

.jpg)

Exploring the impacts of China’s water resource tax policies:

2022年11月4日 Taxation can also improve social welfare, and the optimal tax rate level is the combination that water resource tax is 4 Yuan/m3, and the water pollution tax is in the range of 56–84 Yuan A resources tax can be a policy tool to prevent NRD This tax aims to increase access to natural resources for future generations while encouraging technological advancements that promote efficient resource use (Costanza Daly, 1992) Some studies provide evidence that Resource Tax (RTAX) can serve as an effective tool to improve EQA step towards sustainable environment in OECD countries: GAMES WORKSHOP GROUP PLC’S TAX STRATEGY This Tax Strategy is published in accordance with Para 16(2), Schedule 19, Finance Act 2016 for Games Workshop Group PLC and its UK subsidiaries for the financial year ended 2 June 2024 IntroductionTax Strategy Games Workshop Group PLC Investor Relations2024年3月15日 Tax 2 Reviewer Atty Bolivar Notes Free download as PDF File (pdf), Text File (txt) or view presentation slides online The document discusses key concepts and principles related to value added tax (VAT) in the Philippines It defines VAT and explains why it is called value added tax It also covers topics like persons liable for VAT, exempt and zerorated sales, Tax 2 Reviewer Atty Bolivar Notes PDF Value Added Tax Taxes

Papua New Guinea Resource Project Taxation PwC

2015年6月3日 Resource Projects 1 The income tax law contains a basic set of rules which apply to the taxation of all types of resource projects There are then further specifi c rules which apply to different types of resource projects ie mining, petroleum and gas projects 2 The rates of taxation on mining, petroleum and gas income in Papua NewEach workshop includes a QA portion with the speakers as well The ED Sales Tax Workshop is the required training under the Texas Local Government Code Section 502101 governing Type A and Type B EDCs The cost of registration Economic Development Sales Tax Workshops / 2022年9月1日 1 Introduction The “resource curse” has been proposed (Auty, 1994) to explain the phenomenon whereby a wealth of natural resources hinders the sustainable development of an economy and even leads to stagnation or retrogression rather than providing a longterm impetus for economic growthIn recent decades, many countries, such as Nigeria, Iran, The impact of resource taxation on resource curse: Evidence 2022年11月23日 Thank you for volunteering for the Property Tax Protest Workshops SALSA is collaborating with the City of San Antonio Texas Rio Grande Legal aid to facilitate these workshops in each city council district Resources Exemptions112322pdf (bcad) 96295 Property Taxpayer Remedies (bcad)Property Tax Protest Workshops Resource Page San

REGIONAL WORKSHOP ON TAX EXPENDITURES Addis

2024年3月13日 REGIONAL WORKSHOP ON TAX EXPENDITURES Sourcebook for Workshop Participants 3 WORKSHOP AGENDA Day 1: Governance, Estimation, and Reporting of Tax Expenditures 08:30 –09:00 Registration 09:00 –10:00 Welcome Address Introduction ATI, FIRS, ECOWAS, WATAF, ATAF IDOS / CEP 10:00 –11:20 Session 1 – A Governance 2024年11月26日 AgriLife Bookstore AgriLife Extension's online Bookstore offers educational information and resources related to our many areas of expertise and programming; from agriculture, horticulture, and natural resources to nutrition, wellness for Resources Tax Workshops2024年1月1日 Studies and the development experiences of already developed nations suggest that resource taxes are a crucial financial tool to offset the increasing cost of natural resources (Lin et al, 2023)They hold significant policy implications for promoting responsible resource exploitation and conserving the environment (Hu et al, 2021)The resource tax essentially Will resource tax reform raise green total factor productivity 2024年6月14日 These workshops are designed to help you, a new business owner, understand and meet your federal tax obligations These lessons are constructed so that the first four segments: Federal Taxes And Your New Business, Schedule C and Other Small Business Taxes, How to File and Pay Your Taxes Electronically, and Business Use of Your Home, may be IRS Small Business Tax Workshops SCORE

.jpg)

Masterclasses, Intensives and Workshops The Tax Institute

4 天之前 The Tax Institute is Australia's leading professional association and educator in tax, providing the best resources, professional development and networks Learn more Our people Councils Committees; Leadership team; Tax Policy Advocacy team Intensives and Workshops Short half day, full day, in person or online events, that go in 4 天之前 Tax Briefs Attendees will be updated on recent tax issues and learn about the practical impact of recent tax changes You’ll also learn how to apply the changes in a client context and how to recognise planning opportunities Tax Updates cover important tax issues, such as: Income tax, including CGT Other taxes such as GST and FBT Tax Tax Workshops TaxBanter Pty Ltd